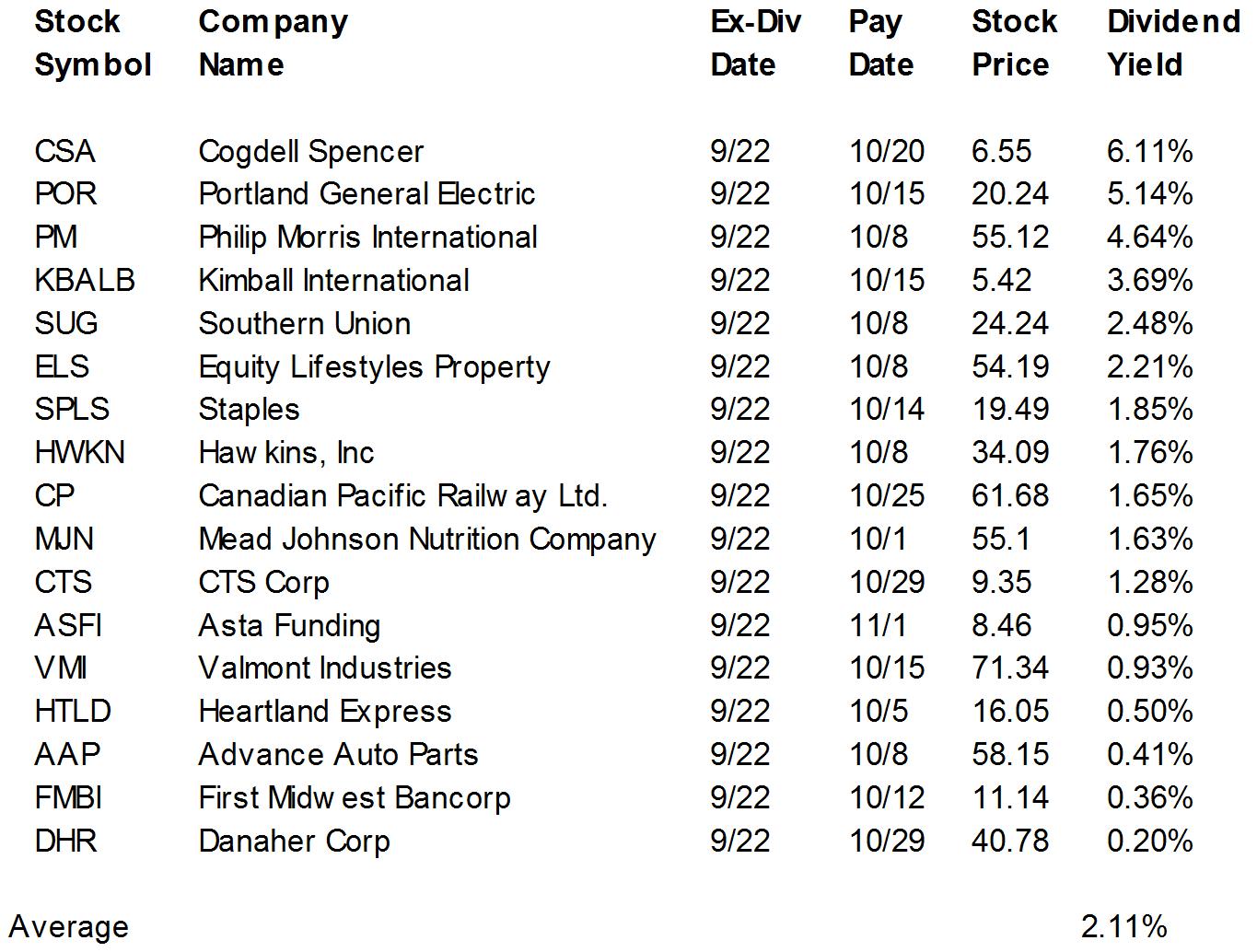

Of course, that is a completely meaningless comparison without also knowing how many shares outstanding there are for each of the two companies.įurthermore, via issuance of new shares over time, or the repurchase of existing shares, the number of shares outstanding can fluctuate over the course of history. Many "beginner" or "novice" investors will look at one stock trading at a price of $10 per share and another trading atĪ price of $20 per share and think the latter company is worth twice as much.

Understanding the changing numbers of IPHI shares outstanding - andĬomprehending the concept of differing number of shares outstanding in general comparing companies like IPHI versus peers. We show 44 historical shares outstanding datapoints in our coverage of IPHI's shares outstanding history. has shipped engineering samples and products under development, that perform a range of functions such as amplifying, encoding, multiplexing, demultiplexing, and retiming signals at speeds up to 400 Gbps. has a range of products in its portfolio, including products that have commercially shipped, products for which Co. Co.'s solutions provide an interface between analog and mixed signals and digital information in systems such as telecommunications transport systems, enterprise networking equipment and data centers. Looking at the next fiscal year, 7 estimates have moved upwards while there have been no downward revisions in the same time period.Inphi is a provider of analog and mixed signal semiconductor solutions for the communications and cloud markets. These revisions helped boost IPHI's consensus estimate, increasing from $3.31 to $3.35 in the past 60 days.

#IPHI DIVIDEND FULL#

Over the past two months, 7 earnings estimates moved higher compared to none lower for the full year. A nice path here can help show promise, and we have recently been seeing that with IPHI. Please note that estimate revision trends remain at the core of Zacks Rank as well. The Zacks Momentum Style Score also takes into account trends in estimate revisions, in addition to price changes. IPHI is currently averaging 1,751,892 shares for the last 20 days. Volume is a useful item in many ways, and the 20-day average establishes a good price-to-volume baseline a rising stock with above average volume is generally a bullish sign, whereas a declining stock on above average volume is typically bearish. Investors should also pay attention to IPHI's average 20-day trading volume. In comparison, the S&P 500 has only moved 4.51% and 13.71%, respectively.

Over the past quarter, shares of Inphi have risen 25.59%, and are up 100.48% in the last year. While any stock can see a spike in price, it takes a real winner to consistently outperform the market. Shares are looking quite well from a longer time frame too, as the monthly price change of 26.03% compares favorably with the industry's 6.86% performance as well. It is also useful to compare a security to its industry, as this can help investors pinpoint the top companies in a particular area.įor IPHI, shares are up 18.12% over the past week while the Zacks Semiconductor - Analog and Mixed industry is down 3.08% over the same time period.

Let's discuss some of the components of the Momentum Style Score for IPHI that show why this chip designer shows promise as a solid momentum pick.Ī good momentum benchmark for a stock is to look at its short-term price activity, as this can reflect both current interest and if buyers or sellers currently have the upper hand. You can see the current list of Zacks #1 Rank Stocks here > Our research shows that stocks rated Zacks Rank #1 (Strong Buy) and #2 (Buy) and Style Scores of A or B outperform the market over the following one-month period. Inphi currently has a Zacks Rank of #2 (Buy).

It's also important to note that Style Scores work as a complement to the Zacks Rank, our stock rating system that has an impressive track record of outperformance.

#IPHI DIVIDEND DRIVERS#

We also discuss some of the main drivers of the Momentum Style Score, like price change and earnings estimate revisions. Below, we take a look at Inphi (IPHI), which currently has a Momentum Style Score of B.

0 kommentar(er)

0 kommentar(er)